A New Way to Buy Self Storage Facility Insurance

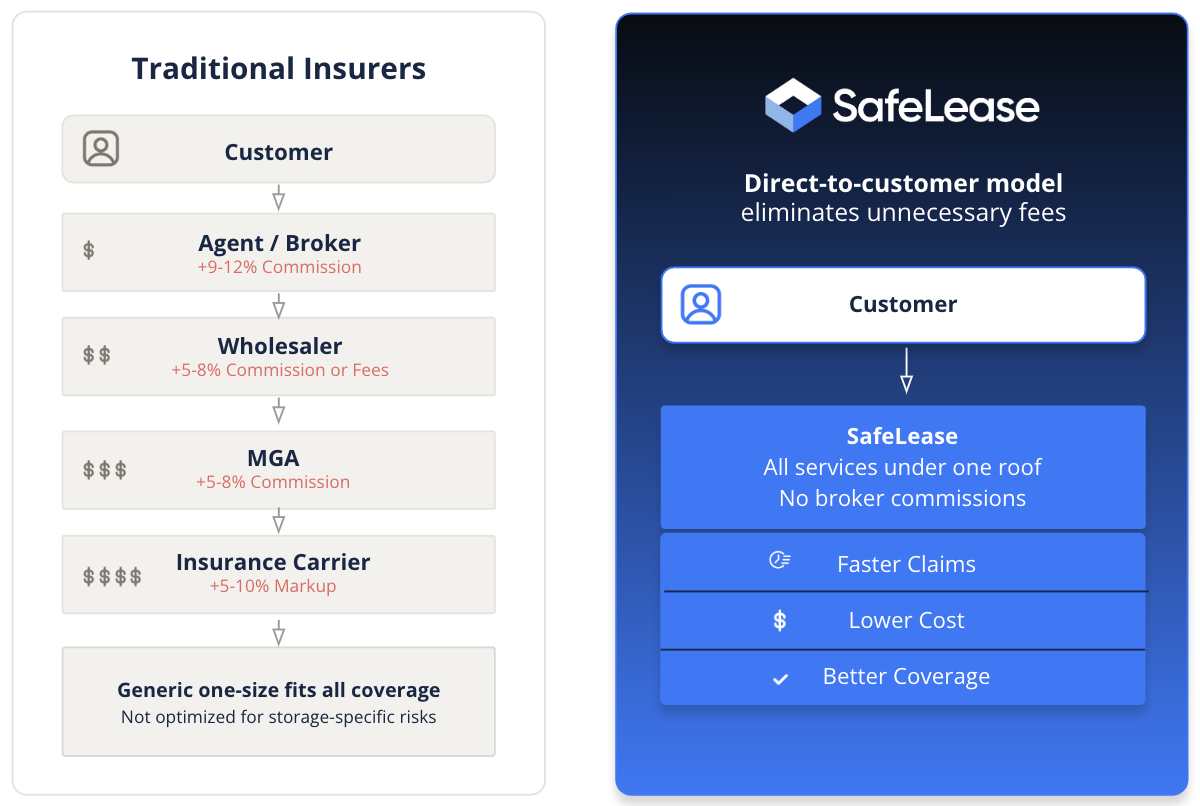

For decades, self-storage operators have had to choose between generic policies or brokered programs that add cost without necessarily adding coverage. Now there's a new approach to buying self-storage facility insurance. SafeLease has introduced an innovative direct-to-operator insurance model designed for self-storage, delivering specialized coverage while removing broker commissions.

The Hidden Cost of Broker Commissions

When you purchase insurance through a broker, you’re also paying their commission – typically 10–20% of your total premium.1 These fees are baked into your policy, not broken out. For example, a multi-facility operator paying $50,000 annually could spend $5,000–$10,000 on commissions alone. That’s money you never see - because it goes to a middleman instead of protecting your facilities. With SafeLease, that cost is removed. Going direct means your premium goes toward protection - not intermediaries. This structural savings matters more than ever in today's insurance market.

Rising Premiums Increase the Need for Savings

The commercial property insurance market has seen significant increases in recent years. In Q1 2023, premiums rose 20.4%2—the largest spike in two decades. While 2024 saw some moderation, the cumulative impact of rising rates remains a real challenge for operators.3

Cutting broker fees is one of the few levers left to reduce insurance costs. But cost alone isn’t the only reason to go direct.

When Specialized Self-Storage Coverage Matters

Most general commercial policies fail to address key risks in self-storage operations—and may include irrelevant protections (like fine art coverage). For example, a single water leak in a hallway can damage 10+ units—something general commercial policies often overlook.

Working with an insurance provider that truly understands the self-storage business ensures your policy includes the coverages that actually matter, such as:

Liability Coverages:

- Sale and Disposal Liability for lien sales - up to $1M

- Customer Goods Legal Liability for tenant property in your custody

Facility Coverages:

- Location-based deductibles - instead of per-building deductibles

- Agreed-upon valuations for different buildings (ex. climate-controlled vs. standard)

- Business interruption coverage tailored to storage, for up to 18 months

- Change in ordinance coverage to help cover costs of rebuilding to updated codes after a covered loss

Our team’s focus on self-storage means we understand the details that matter - like how water damage can impact multiple tenants, or how roll-up doors create different risks than traditional ones. This expertise shapes every aspect of SafeLease policies. All coverages are underwritten by an A-rated carrier (Obsidian Insurance).

The Direct Advantage in Practice

Faster, More Informed Quotes

Traditional process → Broker shops carriers and you wait weeks for quotes

Direct process → Get a tailored quote from storage specialists in 48 hours

Insurance That’s Tailored to Your Portfolio

We offer flexibility that’s typically not offered through traditional channels, such as:

- Deductibles matched to location - select different levels for different facilities.

- Greater cost control - select higher deductibles and focus protection on covering major catastrophe-type events only.

- Cover unique risks by adding protections for equipment breakdown or terrorism.

Expert Claims Handling Without Delays

Working directly with a storage insurance specialist also means a better claims experience:

- No communication delays from middlemen

- Adjusters who understand storage operations

- Faster, more accurate claims resolutions

Making the Switch

Direct insurance is more than just a cost-saving strategy - it’s a smarter way to protect your business. SafeLease offers:

- 15–20% savings by eliminating commissions

- Purpose-built storage policies

- Direct access to specialized experts

- Streamlined claims support

Sources

- SIAA, The nuts and bolts of independent insurance agent commission rates, 2022

- CBIZ, April 2024, Navigating the 2025 Commercial Property Insurance Market

- The Council of Insurance Agents and Brokers, March 2024, 25 Straight Quarters of Premium Increases for Commercial Lines: CIAB Survey

%20(1).jpg)